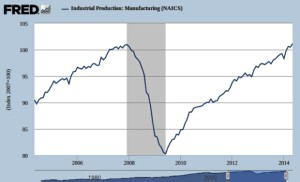

According to the most recent data released by the Federal Reserve, U.S. industrial production as measured by the Fed’s manufacturing index (see chart), reached 101.2 in May, finally surpassing the previous peak of 101.0, reached in December 2007.

Following that peak, the “Great Recession” ensued in January 2008, with the index of manufacturing industrial production plunging to 80.3 by June 2009, a drop of more than 20 percent.

Since mid-2009 until May, the U.S. economy has been mired in a period of stagnation/depression, while an unusually weak recovery got under way. This phase of the capitalist industrial cycle normally follows the crisis phase—the phase when industrial production plummets and unemployment soars.

The 2007-2009 crisis was precipitated by the bursting of a speculative bubble pumped up by an overproduction of housing as well as most other commodities in relation to the purchasing power of debt-burdened consumers. Millions of working-class and middle-class people lost their homes and jobs as a result, and capital, including finance capital, became more centralized in fewer hands—as occurs in every overproduction crisis as a result of mergers and bankruptcies.

Although this crisis took a particular form, overproduction crises, worldwide in scope, have been a regular feature of capitalism since 1825, usually about every 10 years, despite all attempts of pro-capitalist economists and policymakers to eliminate them. (The latest “tool” these types have come up with is “macroprudential regulation,” touted in a recent speech by new Federal Reserve head Janet Yellen.)

The founders of scientific socialism, Karl Marx and Frederick Engels, showed that these crises are in fact inherent in capitalism owing to its ability to rapidly expand production to an extent far exceeding the capacity of a slower-growing market to absorb the resulting flood of goods and services. This turned out to be the case again, even with the unprecedented extension of credit that we saw preceding the last crisis. The huge expansion of debt simply allowed the overproduction bubble to inflate a bit longer and to a larger size before it burst.

Working people, the capitalists and even the imperialist governments themselves with all the taxing power at their disposal can take on only so much debt before actual or potential bankruptcy looms.

(For a more detailed discussion of the capitalist industrial cycle, see my previous article on the subject here.)

The phase of ‘average prosperity’

While it is possible that manufacturing industrial production could fall back in coming months, the more likely outcome is that the phase of what Marx termed “average prosperity” that the U.S. economy now appears to have entered will continue for some months before turning into the final phase of the capitalist industrial cycle—the “boom”—that will precede the next and possibly even more devastating crisis, due around 2017.

The recent official data on employment and unemployment buttress this assessment. On July 3, the Labor Department released what Forbes called “a surprisingly strong” jobs report showing that employers added 288,000 jobs in June, more than the 215,000 expected. Moreover, the May numbers were revised upward from plus 217,000 to 224,000 jobs, and the even stronger April numbers from 282,000 to 304,000.

A different survey of households showed that the official unemployment rate dropped from 6.3 to 6.1 percent in June, the lowest rate since September 2008.

These numbers reflect a snapback of the U.S. economy from a temporary slump in the first quarter of this year. That downturn of nearly 3 percent of GDP (annual rate) was largely attributed by financial commentators to the harsh winter weather, but likely also was the result of an overbuilding and then liquidation of inventories—commodity capital—part of a shorter cycle of the capitalist economy known as the “Kitchin cycle.” This cycle, approximately 40 months in length and based on inventory fluctuations, is named after the pro-capitalist economist Joseph Kitchin, who allegedly discovered it in the 1920s, though Marx was aware of it long before.

Organizing low-wage workers

While the recent employment numbers reflect some strengthening of the economy, we should keep in mind that most of the new jobs created are low paid and/or part-time, while long-term unemployment remains at unprecedented levels. However, the burgeoning movement of low-wage workers and their supporters for a $15 an hour minimum wage and the right to form unions will no doubt be given added impetus as a result.

Just as the sharp upturn of employment in the period following the super-crisis of 1929-33 gave impetus to the great movement that resulted in vast numbers of U.S. industrial workers becoming organized into the CIO unions, the current upturn can have a similar effect on the efforts to organize low-wage workers, who have already begun to move—and on a world-wide scale, no less.

This is the exciting prospect that lies before us.