In a previous article, I attributed the economic difficulties China is now experiencing—which set off the recent global stock market panic—to several factors: the weak recovery of the global economy from the “Great Recession” of 2007-2009, exacerbated by austerity policies imposed by capitalist governments of the European Union and elsewhere; Federal Reserve monetary tightening; and the strong U.S. dollar causing prices of oil, copper and other primary commodities, denominated in dollars, to plunge.

The “secular stagnation” afflicting the global economy has caused a slump in Chinese exports and consequently also its imports of raw materials and component parts needed to produce the wide range of commodities China now supplies the world.

I also emphasized that the capitalist industrial cycle continues to operate and that another crisis of overproduction is approaching. I even raised the possibility of another crisis that would eclipse the super-crisis of 1929-1933, which marked the beginning of the 1930s Great Depression. I cited several parallels between now and the period leading up to that calamity.

Although a few pro-capitalist economists, mostly adherents of the reactionary, anti-democratic “Austrian school,” write and talk of such a possible, and even inevitable, outcome, virtually no mainstream economists, whether progressive or conservative, think another major crisis on the scale of the early 1930s super-crisis is in the cards. They claim that the lessons learned from that experience ensures it will not be repeated.

Widely touted as the leading expert on the Great Depression and the lessons learned is Ben Bernanke, former chair of the Federal Reserve, the U.S. central bank—which, given the role of the U.S. dollar as the main reserve currency globally, serves as the world’s central bank.

The main lesson Bernanke drew was that the super-crisis and subsequent Great Depression could have been avoided if the Federal Reserve had only flooded the banking system with liquidity—newly created paper money—thereby preventing the ruinous fall in prices that brought about economic collapse and widespread bank runs and failures. He put that conclusion into practice in 2008-2009, once the Great Recession had gotten underway, launching several rounds of “quantitative easing”—that is, purchasing enormous quantities of government and mortgage bonds using the electronic equivalent of newly created paper dollars.

The result has been a major bull market in bonds—and in stocks—and historically low long-term interest rates that were supposed to stimulate economic recovery. The major banks, which were de facto bankrupt, were bailed out as were many other financial institutions and money capitalists who otherwise would have been wiped out as a result of risky lending. Although prices of oil, copper and other primary commodities plunged, a steep depreciation of the paper dollar against the money commodity gold prevented a general deflation in dollar terms.

The parallels

In my previous article, I cited several apparent parallels between the recent period and the period leading up to the early 1930s super-crisis that point to the possibility of another such crisis:

- Fast-growing China has in the recent period been playing a similar role in the global economy as the United States did in the early 20th century. (It should be noted, however, that China remains an oppressed country, which the Party for Socialism and Liberation holds to be a workers’ state, with a strong state-owned sector and stated aim of constructing socialism in the long run. The U.S., in contrast, had already become a major imperialist power by the early 20th century, and on a per capita basis and in terms of labor productivity was relatively stronger compared to the rest of the world than China is today.)

- China’s extraordinary economic growth prior to the Great Recession drove prices of primary commodities such as oil and copper to unsustainable heights, far above underlying labor values. The economic demands created by World War I had a similar effect but in addition drove virtually all prices above underlying labor values.

- The declining, though still dominant, U.S. empire today is playing a similar role economically and geopolitically as the declining, though still dominant, British empire played in the early 20th century.

- Britain at that time oriented its foreign policy toward “containing” fast-rising Germany, while the “Asia pivot” of the U.S. today aims at containing China.

More parallels can be drawn, further strengthening the possibility of another super-crisis down the road:

- Britain was de facto forced off the gold standard as a result of the need of the government to finance the huge outlays for World War I. These outlays were largely financed by money capitalists of both Britain and the U.S. buying enormous quantities of British bonds—who faced great losses either if Britain lost the war, likely causing the bonds to become worthless, or if Britain won but could not go back to the gold standard at the previous legally defined parity of its currency (the pound) to gold.

- The U.S. was forced off what remained of the gold standard (the monetary system set up at a conference held in Bretton Woods, N.H., in 1944), in the early 1970s as a result of the financial strains resulting from simultaneously financing the Vietnam War and President Johnson’s “Great Society” programs (in response to a series of urban uprisings of African American communities) through deficit spending, again financed to a large extent by bond sales to money capitalists. The subsequent decade or so of “stagflation” saw a major depreciation of the dollar against the money commodity gold and resulting steep fall in the value of bond holdings. At its worst, the gold value of a dollar—and therefore bonds denominated in dollars—plunged from 1/35th of an ounce (the previous legal fixed parity) to 1/875th of an ounce in January 1980. Needless to say, the money capitalists were not pleased.

- At the end of WWI, Britain and France in an initial attempt to recover the losses of the war, especially to the bondholders, imposed draconian reparations on defeated Germany. In 1925, after it had become clear that Germany was unable to meet it reparations obligations, Britain’s government and Bank of England put the pound back on the gold standard at its pre-war parity. This meant a sharp rise in the gold value of the currency, which caused a vicious deflation.The fall in prices, including wages, led to the famous British General Strike of 1926, which in the end was defeated. With the world recession that started in 1929, prices fell even more steeply, causing widespread bank failures in 1931 and forcing the pound off the gold standard once again, in September of that year.

- The parallel in the late 1970s United States to the British attempt to make the bondholders whole in the 1920s, was the initiation of neo-liberal policies—first under the Carter administration and then greatly expanded under Reagan and subsequent administrations—and the “Volcker shock” of 1979-1980. The latter action, carried out by the Fed chairman, Paul Volcker, a Democrat banker appointed by President Carter in August 1979, caused a sharp rise in interest rates, which led to Reagan’s landslide electoral victory in November 1980 and to the deep recession of the early 1980s.

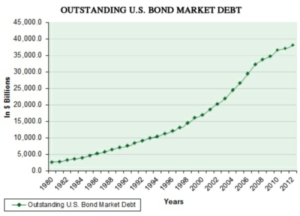

The sky-high interest rates and recession stabilized the dollar, which in January 1980 had gone into free fall, and had it continued unabated would have meant the end of the U.S. empire. In the ensuing extended period of relatively steady economic growth, production of the money commodity gold rose (enabling the expansion of money and credit even while the dollar appreciated in value), and interest rates fell. Bond and stock prices soared, wiping out their previous losses and bringing new riches to the ruling class. Capitalists in this period increasingly transformed themselves from industrial to money capitalists as neo-liberal policies took hold, de-industrialization of the country took off, and working-class and middle-class people were forced to take on more and more debt to maintain their living standards. Money capitalists, facing a dearth of other investment opportunities, were happy to extend the needed credit.

The sky-high interest rates and recession stabilized the dollar, which in January 1980 had gone into free fall, and had it continued unabated would have meant the end of the U.S. empire. In the ensuing extended period of relatively steady economic growth, production of the money commodity gold rose (enabling the expansion of money and credit even while the dollar appreciated in value), and interest rates fell. Bond and stock prices soared, wiping out their previous losses and bringing new riches to the ruling class. Capitalists in this period increasingly transformed themselves from industrial to money capitalists as neo-liberal policies took hold, de-industrialization of the country took off, and working-class and middle-class people were forced to take on more and more debt to maintain their living standards. Money capitalists, facing a dearth of other investment opportunities, were happy to extend the needed credit.- The (relatively) good times rolled on in the U.S. with only shallow recessions until 2007, when a new major crisis of overproduction began, which saw millions of jobs lost, massive home foreclosures, and the entire banking and monetary system brought to the brink of collapse. This crisis was comparable to some extent to the deep recession immediately following World War I, though the latter was a wartime-to-peacetime conversion crisis, not a normal crisis of overproduction. What makes these crises similar is that preceding both, as already pointed out, prices of primary commodities soared far above underlying labor values.

Role of money commodity gold

To grasp the significance of this divergence, and why—as long as capitalism continues to exist—it must to be “corrected” sooner or later by a violent movement in the opposite direction, the role of the money commodity must be understood.

Though gold itself no longer circulates as a means of exchange and payment it remains the universal measure of labor value. As Karl Marx explained in his famous work “Capital”—and less rigorously by Adam Smith, David Ricardo and other classical political economists who preceded him—it is the law of labor value that regulates production and exchange in the capitalist economy (and provides the scientific explanation of the origin of surplus value, profit and rent).

There is no data collected that makes it possible to measure directly the abstract labor (measured in units of time) socially necessary under current conditions to produce commodities of all kinds. However, an indirect method of measurement emerged within pre-capitalist commodity-producing societies long ago—the money commodity. Eventually, gold (measured in units of weight) emerged as the main money material. The money commodity itself, as Marx explained, must be a product of human labor, providing the mechanism for the law of labor value to regulate the capitalist economy behind the scenes—Adam Smith’s “invisible hand.”

As Marx also explained, “token” or “fiat” currencies such as the paper dollar (and its electronic equivalent), which require virtually no labor to produce, represent—stand in for—gold in circulation. Under a gold standard, the gold value of a currency is legally defined as so many ounces of gold of a specified fineness, and measures are taken by the monetary authority to maintain that parity. In the paper dollar system that began when President Nixon slammed the gold window shut in 1971, the gold value of the dollar fluctuates day to day based on the dollar price of gold in the market. That means the dollar’s gold value now “floats,” is not fixed.

Whether under a gold standard or the current paper currency standard, (real) price is simply the exchange value of commodities in relation to gold, governed by the socially necessary labor required to produce both. Market prices fluctuate day to day around an axis set by this relationship, which itself changes over time based on the amounts of socially necessary labor required to produce the diverse non-monetary commodities on one hand versus the money commodity on the other. *

Bondholders‘ behavior rational—from their but not society’s perspective

This brings us to a key reason behind the downward pressure on prices during the 1920s and 1930s and the austerity and neo-liberal measures imposed by governments of parties serving finance capital today. In both eras, money capitalists resisted taking losses on their bonds brought about by financing expensive wars and/or concessions to the working class.

This brings us to a key reason behind the downward pressure on prices during the 1920s and 1930s and the austerity and neo-liberal measures imposed by governments of parties serving finance capital today. In both eras, money capitalists resisted taking losses on their bonds brought about by financing expensive wars and/or concessions to the working class.

One form of resistance by bondholders is to impose higher interest rates when the currency in which the bonds are denominated is devalued or depreciates, to compensate for the loss of value. This was the case, for example, in the 1970s, when the dollar depreciated sharply while interest rates, both short- and long-term spiraled upward.

(Another example of such resistance by finance capital was the severe monetary tightening by the government and Federal Reserve that produced the 1937-1938 recession after Franklin Roosevelt in 1934 had devalued the dollar by 40 percent.)

The other form the resistance of bondholders takes, especially when the finances of the government that has issued the bonds become shaky, is austerity—layoffs of public workers, shrinking social spending needed by workers and the unemployed, cutting pensions and so on—in short, shrinking “Big Government,” as right-wing politicians like to put it. Only as a last resort will bondholders accept a write-off of debt, since if that is granted to one debtor it sets a precedent for others to demand the same.

Progressive economists influenced by the theories of famous British economist John Maynard Keynes point out that such policies are totally reactionary and even insane—which they are from the point of view of workers and large sections of the middle class. These economists, forgetting the lessons of the 1970s, argue for more deficit spending and money printing by the government while continuing to claim that the capitalist system can be saved through reforms.

From the point of view of the money capitalists holding government debt, on the other hand, austerity and the neo-liberal agenda make total sense. And, after all, they are the ones increasingly in control—of the repressive organs of the state as well as the ability to pay off politicians and buy elections as needed. They, along with big industrial capitalists like the Koch brothers, also finance and promote anti-democratic right-wing movements like the Tea Party, based on reactionary-minded and/or newly impoverished sections of the middle class, and can also be counted on to support outright fascists, should the power of finance capital be seriously threatened by rising progressive and revolutionary mass movements.

Why austerity and deflationary trends could lead to another super-crisis

When prices measured in ounces of gold soar far above underlying labor values, as occurred during WWI (for all commodities) and again prior to the Great Recession (mainly for primary commodities), it means that the purchasing power of gold is falling and the profitability of gold mining/refining is also falling—and in danger of being wiped out altogether. The owners of gold mining and refining companies are industrial capitalists. They will, as all capitalists do, cut back or cease production when profitability falls below the average rate of profit or production is no longer profitable.

But capitalism requires the continued existence and production of a money commodity if the unplanned anarchy of capitalism is to be overcome by regulation of production and exchange through the law of labor value. Despite claims to the contrary by pro-capitalist economists, no other such regulatory mechanism exists in a commodity-based economy. If the economy is to grow, which in the long run is also a requirement for the continued existence of capitalism, production of the money commodity must also increase over time.

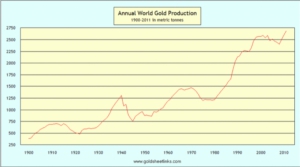

Once commodity prices in gold terms fall sufficiently, as they did during the short but deep post-WWI recession and again during the 1929-1933 super-crisis, again during the deep early 1980s recession, and yet again during the 2007-2009 Great Recession, gold production is stimulated—since such a fall in prices increases the purchasing power of gold, pushing up the profitability of gold mining/refining. (See chart of gold production showing the rising trend of gold production following each of these crises.)

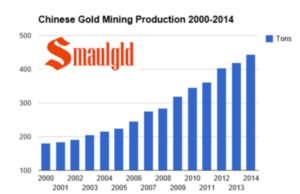

Now again gold production is rising, reaching a new record in 2014 (not shown on the chart). This latest rise is likely due to heavy investment in gold mining by Chinese entrepreneurs wanting to cash in on the soaring dollar price of gold from 2001 to 2011, since China has now become the largest gold producer in the world.

Now again gold production is rising, reaching a new record in 2014 (not shown on the chart). This latest rise is likely due to heavy investment in gold mining by Chinese entrepreneurs wanting to cash in on the soaring dollar price of gold from 2001 to 2011, since China has now become the largest gold producer in the world.

The research arm of Goldman-Sachs recently issued a report predicting that gold production will likely peak in 2015. This is based on the fact that new discoveries of gold peaked in 1995, and production tends to follow discoveries with a lag of about 20 years—the time usually needed to put the new discoveries fully into production.

If a peak does occur this year, and a downtrend in gold production ensues, it becomes all the more likely that another super-crisis is brewing. However, this projection by Goldman Sachs remains to be confirmed, since the bigger determinant of gold production is profitability of mining, which if the current downward trend in primary commodity prices continues, could rise further.

What the future holds

The costs of maintaining the U.S. empire keep rising—both to finance wars (“hard power”) and subversion/destabilization of governments attempting to follow an independent course (“soft power”). Despite major cuts in spending—especially spending that benefits poor and working people—the finances of the U.S. government have not improved all that much. Meanwhile, mass movements in the imperialist countries for a living wage and against austerity and racist attacks on oppressed communities and immigrants are growing. Progressive movements in oppressed countries continue to arise.

Whether or not another super-crisis is on the horizon, the worker’s movement will have to contend with the tyranny of the bond market, and finance capital in general. The future will be one of sharpening contradictions in economics and politics and rising class struggle. That cannot be avoided, as the need to replace this outdated and insane system of capitalism becomes more and more obvious.

_______

*A fuller explanation of the regulatory role of the law of labor value and the money commodity gold that takes into account the capitalist drive to maximize profit in industries with differing ratios of “living” to “dead” labor, transforming labor values into what Marx termed “prices of production,” is beyond the scope of this article but does not affect its basic conclusions.

It should also be acknowledged that many, probably most, Marxist economists do not accept that gold continues to play the role of money commodity and universal measure of value. Rather, they believe, falsely in my opinion, that since the end of the gold standard, gold is now “just another commodity,” and paper (token) money simply reflects the value of all commodities being produced. (back)